Sustainable Investing for Values-Driven Returns

At Adviset Capital Partners, we believe your investments should reflect your values. Discover how we integrate environmental, social, and governance (ESG) factors to build portfolios that pursue competitive returns while making a tangible difference.

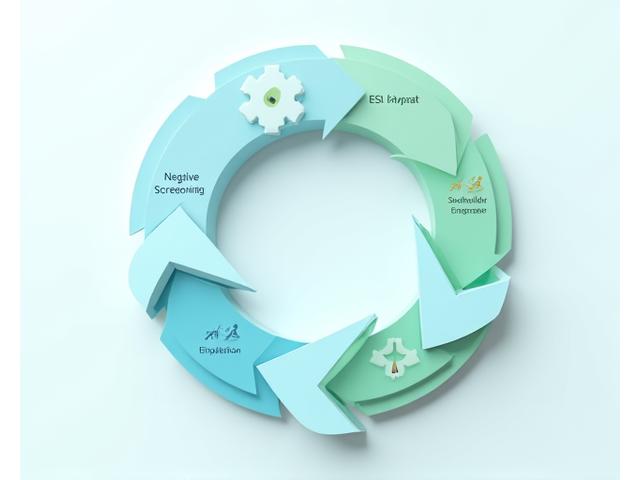

Build Your Values-Aligned PortfolioOur Comprehensive ESG Investment Framework

Adviset Capital Partners employs a robust, multi-faceted ESG framework to ensure your investments align with both your financial objectives and ethical considerations. Our approach goes beyond simple exclusions, focusing on deep integration and active engagement.

-

Strategic Negative Screening

We carefully identify and exclude investments in industries or companies that conflict with widely recognized environmental, social, or governance principles, ensuring your capital avoids contributing to harmful practices.

-

Proactive Positive Screening

Our framework prioritizes companies demonstrating leadership in ESG best practices, fostering innovation and sustainable operations. We seek out entities that are actively building a better future.

-

Holistic ESG Integration

ESG factors are not merely an afterthought; they are deeply integrated into our fundamental investment analysis and decision-making across all asset classes, providing a more comprehensive risk-reward profile.

-

Active Shareholder Engagement

We leverage our influence through proxy voting and direct dialogue with company management to advocate for stronger ESG policies and practices, driving meaningful change from within.

Sustainable Investment Strategies and Solutions

We offer a diverse range of strategies designed to capture the growth opportunities presented by a sustainable future while reflecting your unique interests.

Renewable Energy & Cleantech

Invest in the pioneers of clean energy production, storage, and efficiency technologies. Participate in the global transition to a low-carbon economy.

Sustainable Infrastructure & Green Bonds

Support resilient, environmentally friendly infrastructure projects and capitalize on opportunities in green finance that drive positive societal and ecological impact.

Social Impact & Community Development

Direct capital towards improving access to education, healthcare, affordable housing, and equitable economic opportunities in targeted communities.

Ethical Corporate Governance

Focus on companies demonstrating exemplary leadership, transparent reporting, fair labor practices, and robust ethical frameworks.

Values-Aligned Fixed Income

Access bond portfolios structured to support organizations with strong ESG credentials, offering stable returns while contributing to positive change.

Global ESG Equity

Diversify your portfolio with leading global companies committed to sustainability, innovation, and superior governance practices across various sectors.

ESG Investment Performance and Research

The notion that sustainable investing must compromise returns is outdated. Extensive research and historical data demonstrate that ESG-integrated portfolios can not only match but often exceed the performance of traditional portfolios, particularly over the long term.

-

Competitive Returns

Our analysis shows compelling evidence of ESG strategies achieving competitive, and in many cases, superior risk-adjusted returns compared to conventional investment approaches.

-

Reduced Risk Exposure

Companies with strong ESG practices often exhibit greater operational resilience, superior risk management, and reduced exposure to regulatory or reputational pitfalls, leading to more stable long-term performance.

-

Rigorous Research & Analytics

We employ a dedicated team and cutting-edge analytical tools to continually assess ESG factors across our investment universe, ensuring data-driven decisions that align with sustainable growth.

Measuring and Reporting Your Investment Impact

Transparency is key to true sustainable investing. Adviset Capital Partners provides comprehensive impact reporting, allowing you to see the tangible environmental and social outcomes generated by your portfolio.

-

Quantitative Environmental Metrics

Track measurable outcomes such as estimated CO2 emissions avoided, renewable energy generated, and water saved through your portfolio's holdings.

-

Social Progress Indicators

Understand contributions to social well-being, including job creation, access to healthcare, education advancements, and community development.

-

Governance Improvement Results

Monitor the impact of active ownership through proxy voting, assessing improvements in corporate transparency, board diversity, and ethical conduct.

-

Biannual Impact Reports

Receive detailed, easy-to-understand reports that summarize your portfolio's societal and environmental contributions, along with financial performance.

Customized ESG Portfolio Solutions

Your personal values are unique, and your investment portfolio should reflect that. At Adviset Capital Partners, we specialize in building bespoke ESG solutions tailored to your specific ethical preferences and financial goals.

-

Personal Values Assessment

We begin with a detailed discussion to understand your core values, areas of concern, and desired impact, forming the foundation for your customized strategy.

-

Flexible Criteria Customization

Beyond standard ESG filters, we can implement highly specific positive or negative screens based on your personal convictions, ensuring genuine alignment.

-

Seamless Integration

Your bespoke ESG portfolio is integrated into your broader wealth management and financial planning strategy, ensuring a cohesive and optimized financial future.