Advanced Portfolio Optimization for Superior Returns

Is your portfolio truly optimized for maximum risk-adjusted returns? Adviset Capital Partners leverages institutional-grade analytics and Nobel Prize-winning methodologies to maximize returns while minimizing risk through sophisticated diversification strategies.

Request Your Portfolio Optimization Analysis

Sophisticated Optimization Techniques

Modern Portfolio Theory & Efficient Frontier

We apply the foundational principles of Modern Portfolio Theory to identify optimal portfolios that maximize expected return for a given level of risk, or minimize risk for a given expected return. Our analysis generates an interactive efficient frontier, allowing you to visualize and understand trade-offs in asset allocation.

Black-Litterman Model Integration

Our approach moves beyond historical averages by integrating your unique market views and ours with the Black-Litterman model. This methodology generates more intuitively appealing and diversified portfolios that reflect current market conditions and forward-looking expectations, rather than solely relying on past performance.

Risk Parity & Volatility Targeting

We construct portfolios where each asset class contributes equally to the overall portfolio risk, enhancing stability and diversification. Our volatility targeting strategies adjust exposures dynamically to maintain a consistent risk level, providing greater predictability in varying market cycles.

Factor-Based Optimization

Understanding that returns are often driven by underlying factors, we optimize portfolios based on exposure to key style factors such as value, size, momentum, and quality. This allows for a more granular and sophisticated approach to asset allocation, seeking to capture specific risk premiums effectively.

Monte Carlo Simulation for Scenario Analysis

We utilize Monte Carlo simulations to model thousands of potential market scenarios, assessing the probability distribution of future portfolio outcomes. This robust analysis helps you understand the range of possible returns and potential risks under various economic conditions, informing more resilient planning.

Dynamic Optimization

Market conditions are never static. Our dynamic optimization process continuously monitors your portfolio and market signals, making necessary adjustments to maintain optimal alignment with your objectives. This proactive approach ensures your portfolio remains efficient and responsive to evolving opportunities and risks.

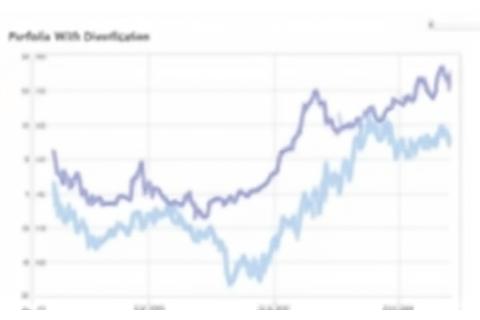

Advanced Diversification Beyond Traditional Assets

True diversification extends far beyond simply holding a mix of stocks and bonds. At Adviset Capital Partners, we build resilient portfolios by strategically integrating uncorrelated assets and employing sophisticated techniques.

- Multi-Dimensional Diversification: Spreading risk across asset classes, geographies, market capitalization, and specific style factors to reduce overall portfolio volatility.

- Correlation Analysis & Clustering: In-depth analysis to identify assets with low or negative correlation, ensuring that components of your portfolio move independently, providing true downside protection during market downturns.

- Alternative Investments: Strategic access to private equity, hedge funds, real estate, and other alternatives that offer unique return streams and further enhance portfolio resilience, typically less correlated with public markets.

- Currency & Commodity Exposure: Thoughtful allocation to global currencies and commodities to hedge against inflation and geopolitical risks, complementing traditional equity and fixed income holdings.

- Private Market Access: Exclusive opportunities in private credit and venture capital, providing institutional-quality diversification and growth potential typically unavailable to retail investors.

Comprehensive Risk Analytics and Management

Understanding and managing risk is paramount to sustained portfolio success. Our robust risk analytics framework provides deep insights into your portfolio's vulnerabilities and strengths, allowing for proactive adjustments.

Value-at-Risk (VaR) & Expected Shortfall

We quantify potential losses over specific time horizons and confidence levels using VaR and Expected Shortfall. This provides a clear, concise measure of your portfolio's exposure to adverse market movements, helping to set realistic risk expectations.

Factor Decomposition & Attribution

Our analysis dissects your portfolio's performance to identify the specific market, industry, or style factors driving returns and risks. This attribution helps us understand the true sources of alpha and make informed adjustments.

Stress Testing & Scenario Analysis

We subject your portfolio to hypothetical extreme market events – 'stress tests' – to gauge its resilience. This forward-looking analysis prepares us for potential downturns and helps refine hedging strategies.

Tail Risk Management & Drawdown Control

We employ strategies specifically designed to mitigate the impact of rare, extreme market events (tail risks) and manage maximum drawdown. Our goal is to protect capital during severe market corrections.

Cutting-Edge Technology Platform

Our commitment to superior portfolio outcomes is underpinned by a proprietary technology platform that integrates advanced analytics with seamless client experience.

- Proprietary Optimization Engine: Our in-house developed engine processes complex algorithms in real-time, delivering rapid and precise portfolio adjustments.

- Integrated Data Streams: Seamless connection with leading global financial data providers ensures access to accurate and comprehensive market information.

- Machine Learning Applications: We leverage AI and ML for pattern recognition, predictive analytics, and identifying subtle market anomalies that traditional methods might miss.

- Secure Cloud Infrastructure: Our platform is built on robust, scalable cloud technology, ensuring enterprise-grade security and reliability for your sensitive financial data.

- Client Portal Experience: Access transparent reporting, performance analytics, and portfolio insights through a secure, user-friendly online portal, available on desktop and mobile.

Portfolio Optimization Success Stories

Enhancing Conservative Returns

A retired client sought to maximize income while maintaining capital preservation. Through precise bond ladder optimization and strategic allocation to low-volatility alternative income streams, we improved their risk-adjusted yield by 1.5% annually without increasing downside exposure.

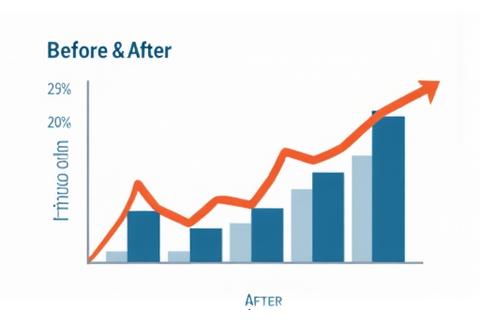

Growth Portfolio Diversification

For a high-growth investor, we integrated emerging market exposure and private tech investments, significantly enhancing diversification without diluting growth potential. This led to a 20% reduction in volatility while maintaining above-market return objectives.

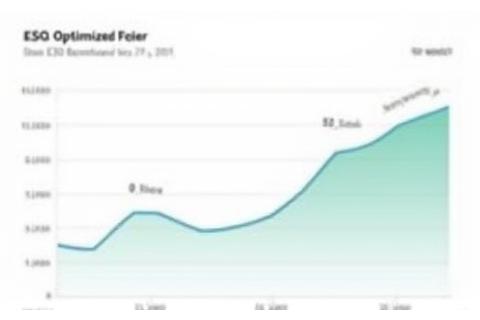

ESG-Integrated Performance

A client with strong ESG principles desired a portfolio aligned with their values without sacrificing returns. Our ESG-constrained optimization identified socially responsible investments that, remarkably, outperformed their non-ESG benchmark by 1.8% over three years.

Ready to Optimize Your Wealth?

Our team of expert financial advisors in Toronto is ready to analyze your current portfolio and design a sophisticated strategy tailored to your unique goals and risk tolerance.

Book Your Personalized Consultation Today