Independent Financial Advisory Services

Are you getting truly independent financial advice aligned with your best interests? At Adviset Capital Partners, our fee-based advisory model ensures completely unbiased guidance, focusing solely on your financial success through comprehensive strategic planning and investment advice.

Comprehensive Financial Advisory Solutions

Our advisory services extend beyond simple investment recommendations. We delve deep into your financial landscape to provide strategic guidance that covers all facets of your wealth.

- Investment strategy development and implementation

- Retirement income planning and distribution strategies

- Tax planning and optimization techniques

- Estate planning coordination and wealth transfer

- Insurance needs analysis and product selection

- Education funding and savings strategies

Our goal is to build a robust financial framework tailored to your unique objectives, ensuring every decision aligns with your long-term vision.

Our Fiduciary Commitment to You

At Adviset Capital Partners, we operate under a strict fiduciary standard. This means our legal and ethical obligation is to always act in your best interest, putting your financial well-being above all else. This contrasts sharply with the 'suitability' standard many others adhere to.

- Legal obligation to act in client's best interest

- Transparent disclosure of all fees and potential conflicts

- Independent research and analysis without product bias

- Regular portfolio reviews and performance reporting

- Continuing education and professional development

This unwavering commitment ensures our advice is truly unbiased, focused solely on helping you achieve your financial aspirations in Toronto and beyond.

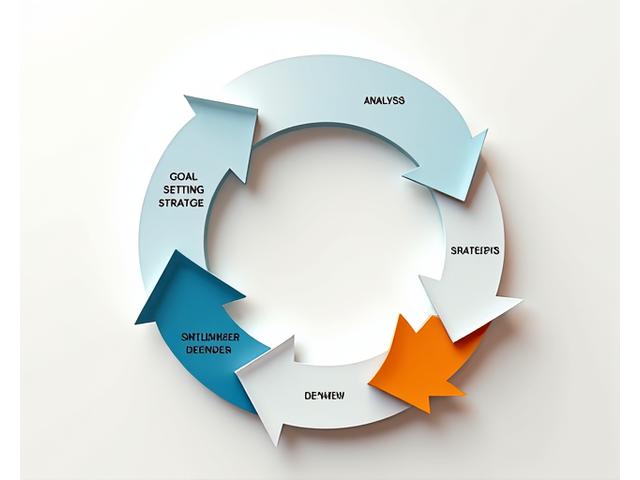

Strategic Financial Planning Process

1. Comprehensive Analysis

We begin with an in-depth review of your current financial situation, including assets, liabilities, income, expenses, and existing plans.

2. Goal Identification

Together, we define your short-term and long-term financial goals, prioritizing them to create a clear roadmap.

3. Strategy Development

We craft customized strategies and model various scenarios, presenting you with clear options tailored to your objectives and risk tolerance.

4. Implementation & Monitoring

We assist with the execution of the plan and continuously monitor its performance against your goals and market conditions.

5. Regular Reviews & Adjustments

Your life and the markets evolve. We conduct regular reviews and make necessary adjustments to keep your plan on track.

Building Long-Term Advisory Relationships

Our commitment goes beyond a single transaction. We believe in cultivating enduring relationships built on trust, proactive communication, and shared success. Your financial journey is dynamic, and so is our partnership.

- Regular meeting schedules with proactive communication

- Life event planning and strategy adjustments

- Market update briefings and portfolio reviews

- Educational resources and financial literacy support

- Family meeting facilitation and next generation planning

We are not just financial advisors; we are your dedicated financial partners, helping you navigate every stage of life's complexities.